About Your Photographer

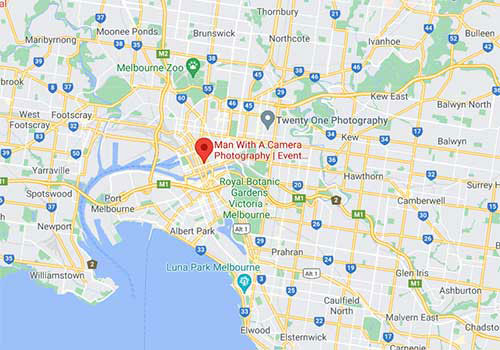

Melbourne Photographer Man With A Camera provides professional photography & videography production for events, conferences, commercial and industrial projects, business branding, annual reports, activations and product launches.

Lead photographer and business owner Simon Woodcock has worked in the photographic industry for over 20 years, starting his career at the BBC before moving into national magazines and newspapers in the UK before relocating to Melbourne.

Simon and his team of photographers have current WWC accreditation and pride themselves on providing a reliable, friendly and respectful service to their broad base of commercial and corporate photography clients, helping them to increase their exposure and amplify their message through the creation of authentic and engaging photography.

Get in touch today to discuss how we can help YOU showcase your event, business or commercial project with professional photography.

Our Photography Clients Include:

Recent Work

Contact us

Get a quote, FAST! Submit your details below and we’ll respond promptly.